Investment gold coins

Gold coins, a liquid investment instrument with a guarantee

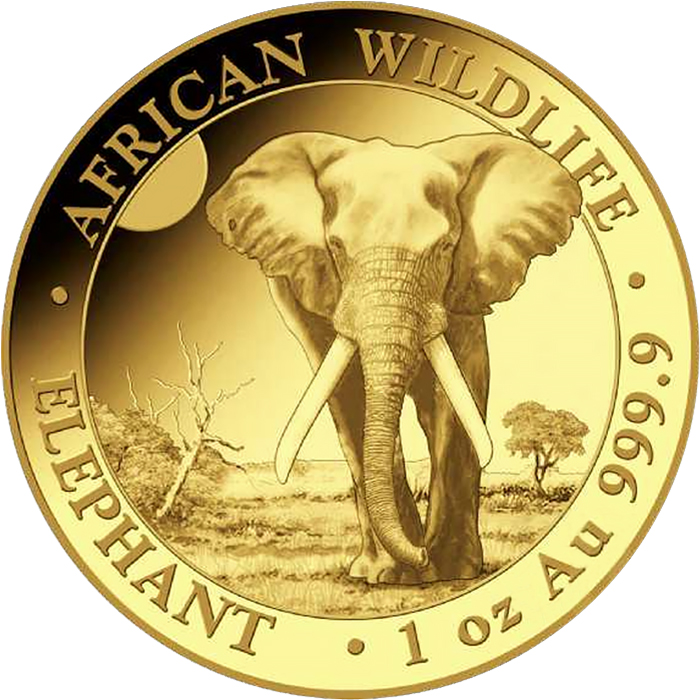

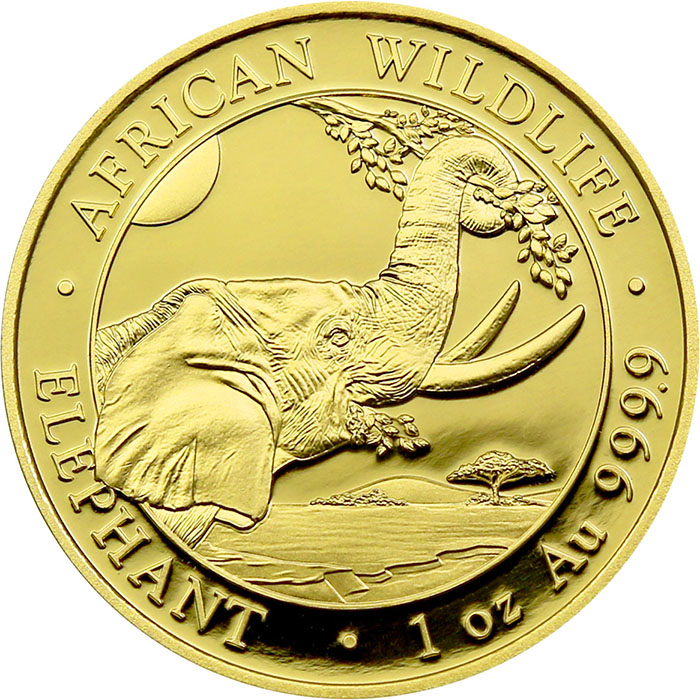

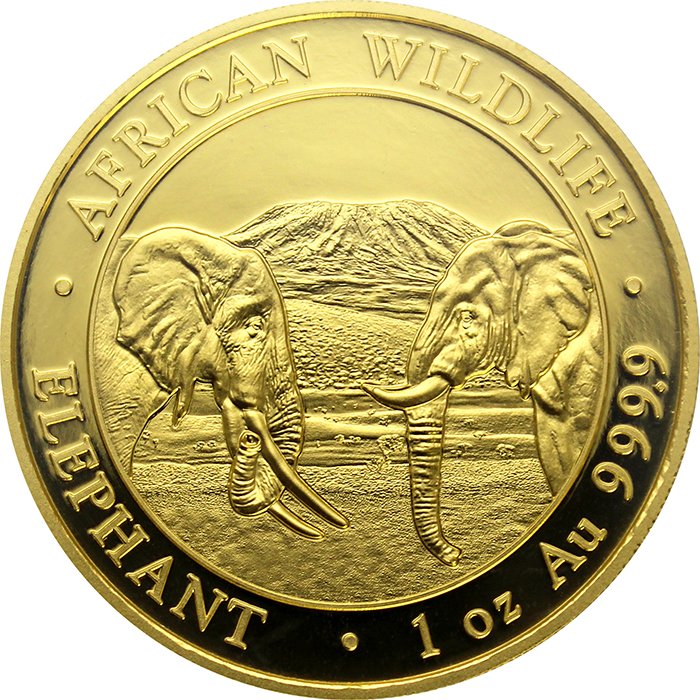

The essence of investment coins (most commonly referred to in English as "bullion" coins) is trading in the precious metal. In contrast, the essence of commemorative coins is to commemorate important people, events, etc., and to collect and trade on the secondary collector's market. Gold investment coins are issued in higher mintage (to meet the needs of the global gold trade) than gold commemorative coins, most often in unified form. One mint usually holds one design for which only the year changes each year (e.g. Maple Leaf, Wiener Philharmoniker, Krugerrand). As a result, mints have very low fixed costs and the selling price of gold coins is close to that of gold bullion, which is the purest form of investment in the precious metal.

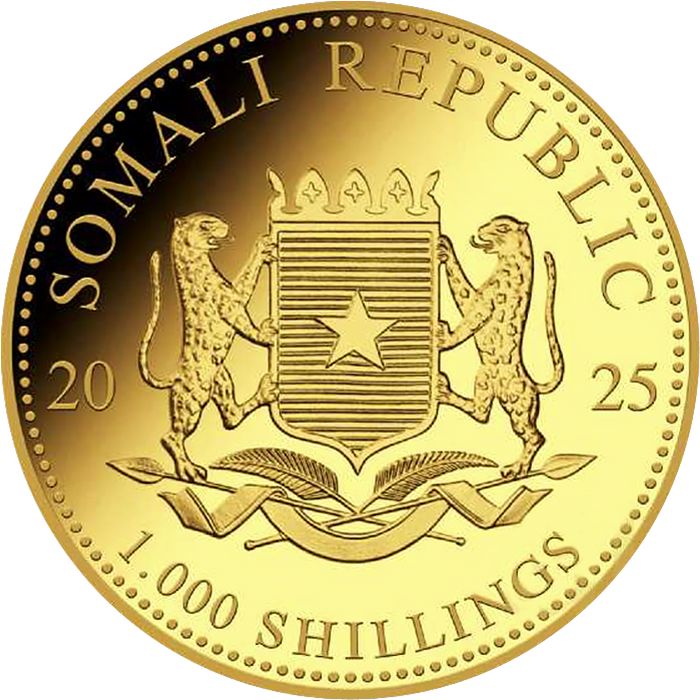

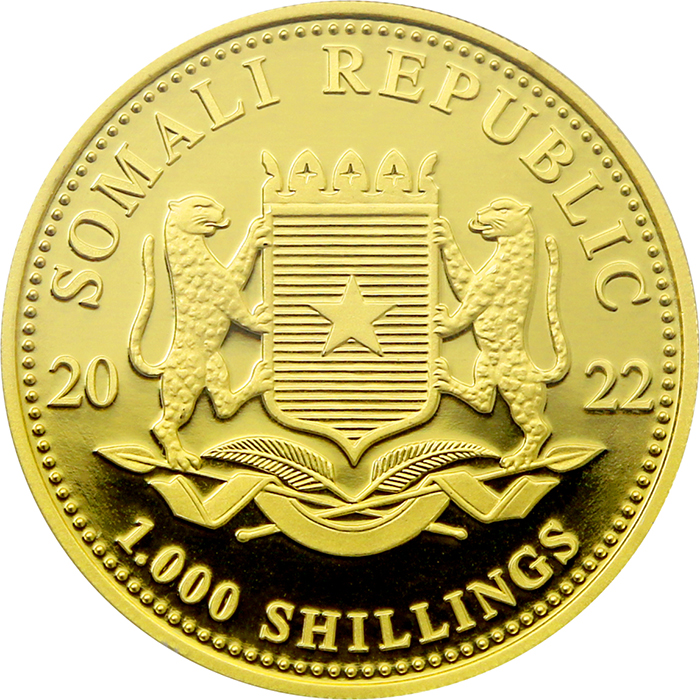

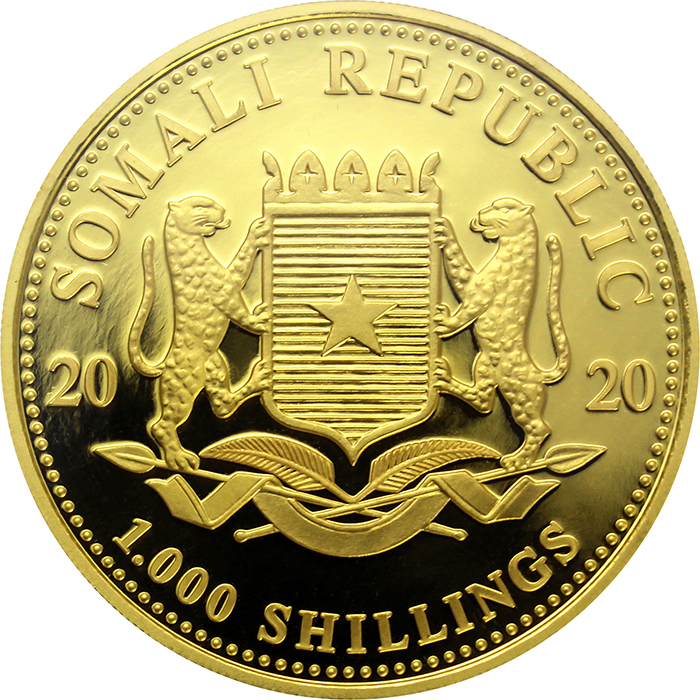

Investment coins are full-value coins, just like circulation or commemorative coins. Full value in the sense that they have a face value and are thus part of the monetary systems of countries. Unlike investment coins minted or cast in private refineries, coins are minted with a guarantee from the mint that mints them and the state authority that issues them (most often state authorities such as finance ministries or central banks). The guarantee is so strong that they do not need a certificate of authenticity. This simplifies the handling and trading of coins (as opposed to bullion).

The guarantee consists, for example, in legislative protection (counterfeiting of coins is more severely prosecuted than counterfeiting of other investment products). Counterfeiting a minted coin is much more technologically complex than an investment coin. For as long as they are valid, investment coins act as legal tender (even a EUR 100 Wiener Philharmoniker coin can theoretically be used to pay for a purchase in a shop). Issuers guarantee that they will always exchange the gold coins for paper money of the same denomination. What is this good for? The value of investment coins, determined by the metal content, is significantly higher than the face value. In the event that the value of the metal falls radically, there is a guarantee of an exchange for the face value (historically, this is highly unlikely; currencies in particular lose value. But any guarantee, even one like this, is a plus for you).

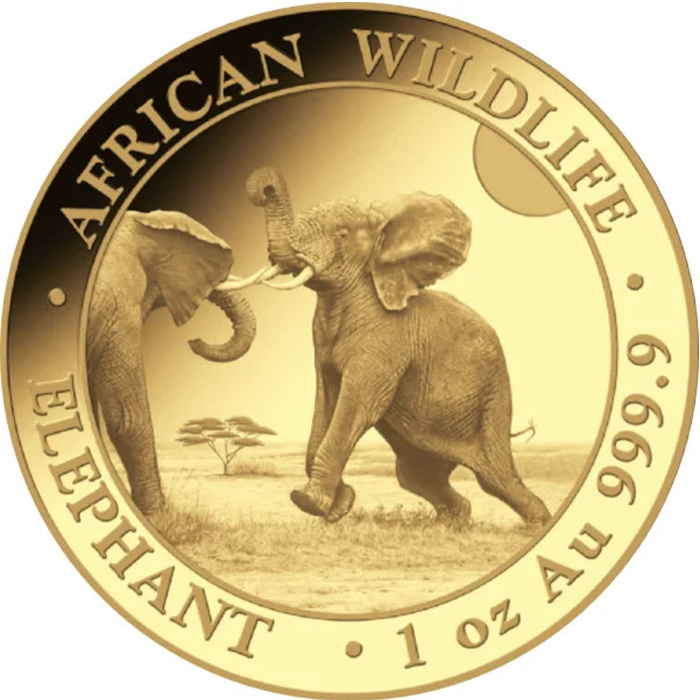

Investment coins are a liquid form of investment. They are traded all over the world. We dare say that there are investment gold dealers in every country on every continent who will buy an investment gold coin from you. Investment coins are more convenient to travel with than bullion coins. For the purpose of transporting them across borders, it is not their real value that is relevant, but their face value (they are legal tender).

Do investment coins have collector value? Some certainly do! Although the essence of trading in investment coins is not the collectible value, but the metal content, some older editions of these coins were minted in lower mintage than their most recent versions. As a result, they are fewer in number on the market, becoming of interest to collectors and increasing in value as a result. The essence of collecting investment coins is the creation of comprehensive collections of vintages. As we have said above, investment coins, like circulation coins, are part of the monetary systems of national currencies. Thus, some numismatists also focus on investment coins and collect all their vintages.