Investment silver coins

Silver coins, alternative tender with high appreciation potential

Silver is the second most used commodity in industry, which is why its reserves are logically diminishing. This is also why many economists believe that the price of silver will increase at a faster rate than the price of gold in the future and why they believe that investing in silver is attractive in the long term.

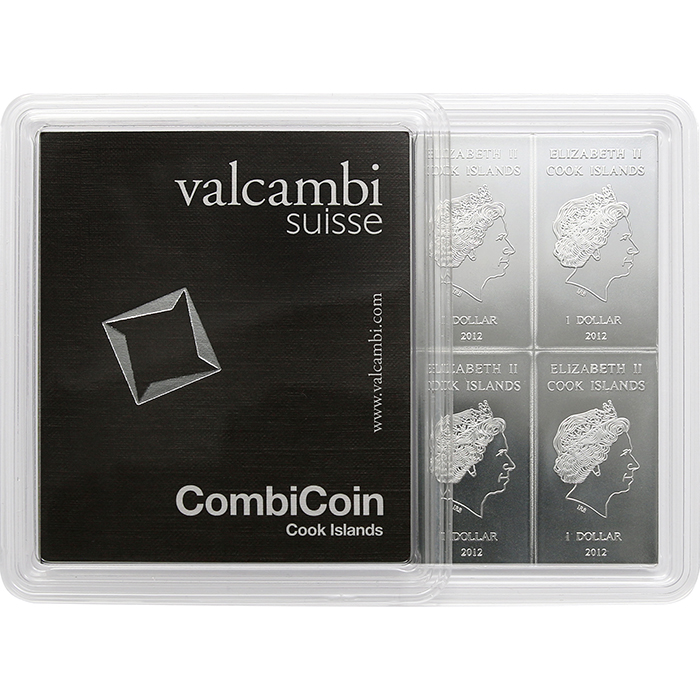

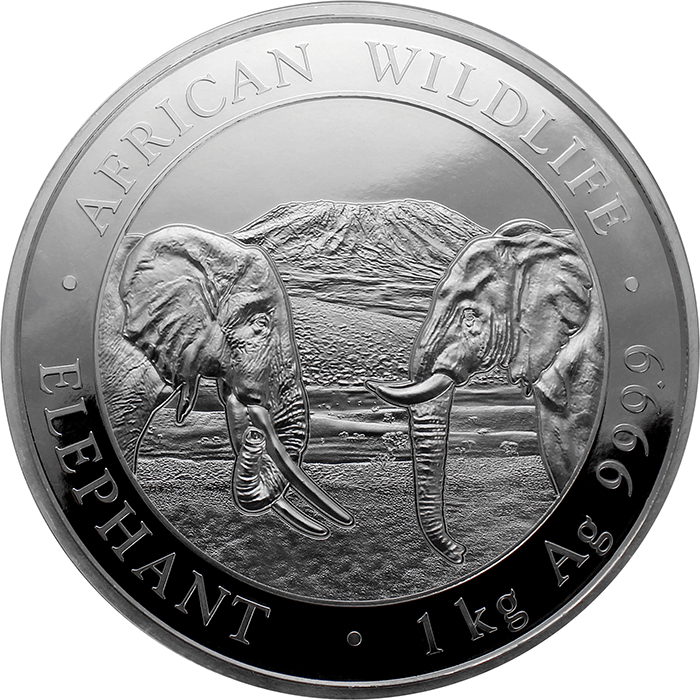

Investment coins, most commonly referred to in English as bullion coins, are the traditional tool for trading precious metals. In addition to investment coins, it is also possible to store your funds in commemorative coins. However, their essence is rather to commemorate famous personalities, important events or buildings. They are acquired for the purpose of collecting and trading on the secondary collector's market. Silver commemorative coins are usually issued at lower mintages than investment coins, which serve the needs of the global silver trade. The production of silver investment coins is associated with very low fixed costs - in fact, mints generally produce silver investment coins of one proven design that changes yearly. The price of silver investment coins is lower than silver bullion coins of comparable weight. We sell significantly more silver investment coins weighing one ounce (31.1 grams) than silver bullion coins. Silver bullion makes sense for investors at higher weights (250 grams, 500 grams, 1000 grams) where the supply of coins is already limited and the price of metal per gram is more favourable.

Investment coins, like circulation or commemorative coins, are part of the monetary systems of countries. This means that they have a face value. They are minted with the guarantee of the mint, which is the manufacturer, and the state authority, which is the issuer of the coin. Such state authorities are most often central banks or ministries of finance. Thanks to the guarantee, it is not necessary to require a certificate of authenticity for the coins, which, compared to ingots, makes them much easier to handle and trade.

Owners of investment coins can rely on legislative protection. Counterfeiting of investment coins is strictly prosecuted precisely because they serve as legal tender. It is much more difficult to counterfeit a minted coin compared to an investment coin. Issuers of investment coins provide additional guarantees by guaranteeing the exchange of investment coins for money of the same denomination. The intrinsic value of an investment coin is higher than its face value due to its precious metal content. However, should the value of the metal drop radically (which is highly unlikely historically) you are guaranteed to exchange the coin for the face value. And any such guarantee is beneficial to the owner of the coin.

Investment coins are a liquid form of investment. Investment coins are traded all over the world, on every continent, in every country. You can travel comfortably and without fear with investment coins, because it is the face value of the coin that counts, not the real value, when transporting them across borders. Always remember that they are legal tender.

Investment coins can also have collector value. Although collectible value is not the essence of trading in investment coins, they can also be very rare. Some older investment coins, for example, were minted in lower mintage, are fewer in number on the market, become of interest to collectors, and thus increase in value. This is another advantage over bullion coins, which are rarely of collector value.